Getting Started with ESEF Compliance

Transitioning to ESEF reporting can be challenging, especially for those new to the process. The learning curve involves understanding the ESEF taxonomy, mastering tagging, and using new software tools.

If you’re new to ESEF or need a refresher on its importance and implications, check out our previous guide explaining what is ESEF. It provides an essential introduction to ESEF, detailing who it affects and why it is crucial for financial reporting.

This blog provides a comprehensive guide on ESEF compliance, offering practical steps to ensure your reports meet regulatory requirements. Here’s a brief overview of what we’ll cover:

- Preparing for ESEF Compliance: Key steps to understand and implement ESEF requirements.

- Training and Resources: Essential training and external resources needed for successful ESEF reporting.

- Practical Steps to ESEF Compliance: A detailed walkthrough of creating an ESEF-compliant report.

- Embracing ESEF for Better Reporting: How to leverage ESEF to enhance transparency and efficiency in financial reporting.

- Get Started with CFOUR Comply: An introduction to CFOUR Comply and how it can simplify your ESEF compliance process.

Preparing for ESEF Compliance: What You Need to Know

Complying with the European Single Electronic Format (ESEF) requires careful planning, training, and the right technological tools. Here are essential steps and considerations for companies on the path to compliance.

Understand the Requirements: The first step is to fully understand ESEF’s requirements, including the mandatory use of XHTML for reporting and iXBRL for tagging financial data. Companies should familiarize themselves with the ESEF taxonomy and how it applies to their financial statements.

Understand the Requirements: The first step is to fully understand ESEF’s requirements, including the mandatory use of XHTML for reporting and iXBRL for tagging financial data. Companies should familiarize themselves with the ESEF taxonomy and how it applies to their financial statements.- Assess Current Systems: Evaluate current financial reporting systems and processes to identify any gaps in capabilities or compliance. This assessment will highlight areas that need enhancement or changes to meet ESEF requirements.

- Implement Necessary Changes: Based on the assessment, implement changes to the reporting processes. This may include restructuring data collection and reporting practices to align with ESEF standards.

- Choose Appropriate Technology: Select software tools that facilitate XHTML conversion and iXBRL tagging. The technology should also support the validation of the reports against ESEF requirements to ensure compliance before submission.

- Test the Process: Before going live with the new system, conduct thorough testing to ensure that all aspects of the financial reporting meet ESEF standards. This should include testing the tagging accuracy and report format.

- Prepare for the First Submission: Assemble all necessary components of the report according to ESEF specifications, and prepare for the first submission by the regulatory deadline.

Training and Resource Considerations for ESEF Compliance

Staff Training: Train finance and IT staff on ESEF reporting requirements and the new tools and systems. This training should cover the specifics of XHTML and iXBRL tagging, as well as how to use the new software effectively.

Continuous Learning: Financial regulations and technologies evolve, so ongoing training and development are crucial. Set up regular training sessions and workshops to keep the team updated.

External Resources: Consider hiring external consultants or using advisory services to bridge knowledge gaps, especially in the initial stages of implementation. These experts can provide insights into best practices and help avoid common pitfalls.

The Practical Steps to ESEF Compliance

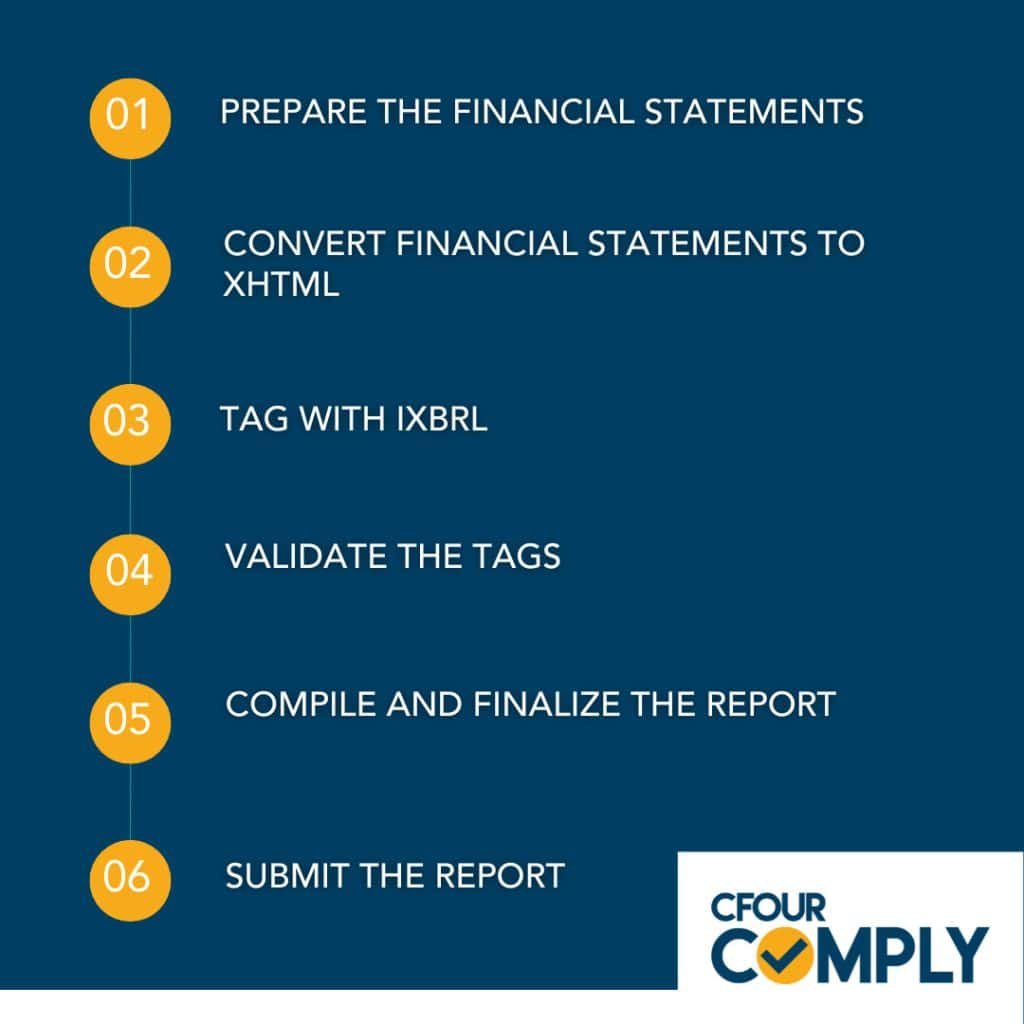

Steps to an ESEF-compliant report

Creating an ESEF-compliant report involves a series of key steps and utilizing specific tools to ensure adherence to EU regulations. Here’s a practical walkthrough to guide you through the :

- Prepare the Financial Statements: Begin by ensuring that your financial statements are accurate and complete. This involves compiling the balance sheet, income statement, cash flow statement, and other relevant documents according to International Financial Reporting Standards (IFRS).

- Convert Financial Statements to XHTML: Once your financial statements are ready, convert them into the XHTML format. XHTML is the required format for ESEF reports because it is both human-readable and machine-readable.

- Tagging with iXBRL: Use inline XBRL (iXBRL) to tag the financial data within the XHTML document. This involves selecting the appropriate tags from the ESEF taxonomy and applying them to the corresponding elements in the financial statements.

- Tag Financial Elements: Start with primary financial statements, tagging elements like revenues, assets, liabilities, etc.

- Tag Notes and Disclosures: Extend the tagging to include the notes and disclosures section, ensuring comprehensive coverage of all reportable elements.

- Validate the Tags: Use validation tools to check that the tags are correctly applied according to the ESEF taxonomy This step is crucial to ensure compliance and to avoid submission errors.

- Compile and Finalize the Report: Once tagging and validation are complete, compile all parts of the financial report into a single XHTML document. Review the document to ensure it meets all regulatory requirements and is ready for submission.

- Submit the Report: Finally, submit the ESEF-compliant report to the relevant regulatory authority by the required deadline. Ensure that the submission process aligns with the specifications provided by the authority

Overcoming Common ESEF Reporting Challenges

Tagging Complexities

Tagging Financial Data with iXBRL presents several challenges, particularly for organizations new to the process or those with complex financial structures. Common complexities include:

Choosing the Right Tags: Selecting appropriate tags from the ESEF taxonomy, which is extensive and detailed, can be daunting. Misinterpretations can lead to incorrect tagging, impacting the accuracy and reliability of the data.

Handling Extensions: When existing taxonomy tags do not precisely match the reporting items, companies must create custom tags (extensions). Managing these extensions while ensuring they are properly anchored to standard tags requires careful attention to maintain compliance and comparability.

Applying Correct Tag Properties: Accurately applying contexts, units, and sign logic in iXBRL tags is essential for meaningful financial reporting. Errors in these properties can lead to misinterpretations of the financial data, significantly impacting its reliability and compliance.

Addressing Data Accuracy Concerns

Ensuring the accuracy of tagged data is critical for compliance and for maintaining investor trust. Common issues include human errors, as manual tagging processes are susceptible to mistakes like applying the wrong tag or inconsistent tagging across similar data types.

Data integrity can also be compromised, with errors occurring during the conversion to XHTML or the tagging process, leading to discrepancies between the reported data and the original financial statements.

Additionally, keeping up with changes in the ESEF taxonomy and compliance rules adds another layer of complexity to maintaining data accuracy.

By addressing these challenges with a combination of advanced tools, proper training, and meticulous quality assurance, companies can enhance the accuracy, reliability, and efficiency of their ESEF reporting process, ultimately leading to better compliance and more reliable financial disclosures.

Stay Informed and Equipped

In the evolving landscape of financial reporting, staying updated on ESEF regulations is crucial. Financial professionals should engage with new guidelines from regulatory bodies like ESMA.

Teams must be trained to handle the technical aspects of ESEF reporting, such as XHTML formatting and iXBRL tagging. Investing in the right technology ensures efficient and compliant reporting processes.

ESEF for Future Success

As ESEF shapes the future of financial reporting, companies must embrace this standard to enhance transparency, compliance, and efficiency. Exploring comprehensive ESEF solutions can simplify the creation, tagging, and validation of financial reports. Consulting services can provide expertise in ESEF compliance, streamlining the reporting process and ensuring accuracy.

Get Started with CFOUR Comply: Your Solution for ESEF Compliance

Navigating the complexities of ESEF compliance can be challenging, but with CFOUR Comply, you have a powerful ally. Designed to simplify and streamline your ESEF reporting process.

This software is designed with ease of use in mind, allowing for quick implementation and minimal training.

Its advanced AI-driven technology facilitates accurate XBRL reporting and speeds up the tagging process, significantly reducing manual effort.

CFOUR Comply’s collaborative features enhance teamwork by allowing financial teams, auditors, and stakeholders to work seamlessly together. Additionally, the platform is future-proofed to accommodate upcoming CSRD requirements, ensuring you stay ahead of regulatory changes.

Book a Demo to learn more about how CFOUR Comply get your ESEF started.