Overview

In the evolving landscape of financial reporting, the European Single Electronic Format (ESEF) has become a cornerstone for companies listed on EU-regulated markets. Understanding and implementing ESEF is crucial for ensuring transparency, efficiency, and compliance in financial reporting. This article will explore the following key points, outlining everything you need to know about ESEF:

- Understanding ESEF: The European Single Electronic Format (ESEF) is a regulatory framework established by ESMA to standardize annual financial reporting for companies listed on EU-regulated markets.

- Purpose and Objectives: ESEF aims to enhance transparency, efficiency, and compliance in financial reporting, facilitating easier comparison and analysis of data across the EU.

- Regulatory Background: The ESEF framework is rooted in the EU Transparency Directive, ensuring that investors receive timely, reliable, and comparable information.

- ESMA’s Role: ESMA developed the ESEF standards, conducted public consultations, and provides ongoing support to assist companies in complying with ESEF requirements.

- Implementation Timeline: ESEF requirements have been in place since January 2020, giving companies ample time to adapt to the new standards.

- Key Components: ESEF reporting involves preparing annual financial reports in XHTML format and using iXBRL tagging based on the ESEF taxonomy.

- Who Needs to Comply: ESEF reporting applies to companies listed on EU and EEA-regulated markets, including newly listed companies that must adopt ESEF standards from the outset.

- Impact on Financial Reporting : Transitioning to ESEF requires new software and tools, staff training, and ensuring data accuracy. However, it offers benefits such as improved data accessibility, increased transparency, and better regulatory compliance.

- Overcoming Challenges : Companies can tackle ESEF implementation challenges with the right tools, such as CFOUR Comply, which simplifies the creation, tagging, and validation of financial reports.

What is ESEF Reporting? Understanding the Basics

Defining ESEF and its full form

ESEF stands for the European Single Electronic Format. It is a regulatory framework introduced by the European Securities and Markets Authority (ESMA) to standardize the annual financial reporting of companies listed on European Union (EU) regulated markets.

The mandate requires these companies to prepare their annual

financial reports in a single electronic format to ensure uniformity and facilitate easier access, comparison, and analysis of financial data across the EU.

Purpose and Objectives of ESEF Reporting

The primary purpose of ESEF reporting is to enhance transparency and improve the accessibility of financial information for investors, analysts, regulators, and other stakeholders.

The key objectives of ESEF reporting are:

Standardization: By requiring a single electronic format, ESEF aims to eliminate inconsistencies in the presentation of financial reports, making it easier to compare financial information across different companies and countries within the EU.

Efficiency: ESEF reduces the time and effort needed to access and analyze financial data by standardizing the format, which facilitates automated processing and analysis.

Transparency: With a standardized format, financial data becomes more transparent, allowing stakeholders to better understand and interpret the financial health and performance of listed companies.

Regulatory Compliance: ESEF ensures that companies adhere to a common set of reporting standards, thus improving regulatory oversight and ensuring compliance with EU financial regulations.

The Regulatory Background of ESEF

EU Transparency Directive

The EU Transparency Directive, formally known as Directive 2004/109/E

It mandates periodic financial reporting, requiring companies to publish annual and half-yearly reports in accordance with International Financial Reporting Standards (IFRS). Additionally, it enforces the disclosure of significant holdings in listed companies to promote transparency regarding ownership and control.

Companies are also required to continuously disclose significant information that might impact their share price, such as insider information and major transactions. Amended by Directive 2013/50/EU, the directive’s legal framework was refined to adapt to new financial market developments.

ESMA’s Role in Developing ESEF

The European Securities and Markets Authority (ESMA) is responsible for improving the functioning of financial markets in Europe and enhancing investor protection. ESMA played a pivotal role in developing the ESEF by:

- Drafting Regulatory Technical Standards (RTS): ESMA developed RTS on the format for annual financial reports. This includes specifying that these reports must be prepared using iXBRL and outlining the ESEF taxonomy based on IFRS.

- Conducting Public Consultations: ESMA engaged with stakeholders through public consultations to gather feedback and refine the ESEF requirements, ensuring they are practical and effective.

- Providing Guidance and Support: ESMA offers guidance documents, implementation support, and technical resources to help companies comply with ESEF requirements. This includes FAQs, explanatory notes, and validation rules.

For more detailed information on ESMA’s role and resources, you can visit the Esma website.

Implementation Timeline

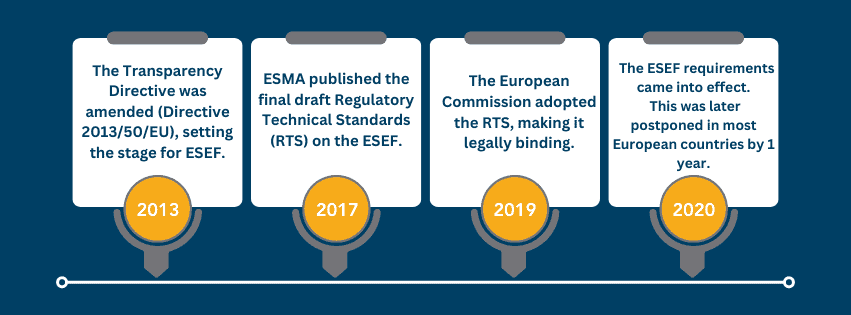

The implementation timeline for ESEF was as follows:

- 2013: The Transparency Directive was amended (Directive 2013/50/EU), setting the stage for ESEF.

- December 2017: ESMA published the final draft of Regulatory Technical Standards (RTS) on the ESEF.

- May 2019: The European Commission adopted the RTS, making it legally binding.

- January 1, 2020: The ESEF requirements came into effect. Companies were required to prepare their annual financial reports for financial years starting on or after January 1, 2020, in accordance with ESEF. This was later postponed in most European countries by 1 year.

- Compliance is ongoing, Companies continue to implement and refine their processes for ESEF compliance, with ESMA providing ongoing support and updates.

The ESEF implementation timeline ensured a gradual transition, allowing companies ample time to adapt to the new reporting requirements while enhancing transparency and accessibility of financial information across the EU.

Key Components of ESEF: From XHTML to Tagging

XHTML Format

XHTML (eXtensible HyperText Markup Language) is a stricter, more XML-based form of HTML. It combines the flexibility of HTML with the robustness of XML, ensuring that documents are well-formed and easily parsed by both browsers and XML parsers. Key characteristics of XHTML include:

- Syntax Rules: XHTML documents must follow strict syntax rules, such as properly nested tags, case sensitivity (all tags in lowercase), and all tags must be closed.

- Document Structure: XHTML documents start with an XML declaration and a DOCTYPE declaration, specifying the version of XHTML being used.

- Compatibility: XHTML documents are designed to be compatible with existing HTML user agents while leveraging the benefits of XML, making them both backward-compatible and forward-compatible.

In the context of ESEF, annual financial reports are prepared in XHTML format to ensure that they are both human-readable (as web pages) and machine-readable (for automated data processing).

ESEF Tagging and its importance

ESEF tagging refers to embedding financial data within XHTML documents using iXBRL (inline eXtensible Business Reporting Language), which enhances both machine and human readability. This process involves associating data points in financial statements with specific tags from the ESEF taxonomy.

The tagged data can be easily extracted and analysed by software applications, facilitating automated data processing and reducing the risk of manual errors. Unlike traditional XBRL, iXBRL retains the human-readable format of financial statements, making them accessible and interpretable directly in a web browser.

Tagging ensures that financial data is reported in a standardized manner, promoting transparency and comparability across different companies and markets. It helps companies meet regulatory requirements, ensuring their financial reports are accurate, complete, and adhere to EU standards.

The ESEF tagging process involves several steps

- Tagging Key Financial Statements: Balance sheet, income statement, cash flow statement, and statement of changes in equity are tagged.

- Tagging Detailed Notes and Disclosures: Provides a complete view of financial information.

- Validation: Tagged reports are validated for compliance with the ESEF taxonomy and regulatory requirements.

- Submission: Validated reports are submitted to relevant regulatory authorities.

Benefits of ESEF Tagging

ESEF tagging offers numerous benefits, including ensuring accuracy and consistency in financial data reporting. It facilitates automated data extraction and analysis, significantly reducing manual errors.

Additionally, ESEF tagging maintains the readability of the original document, enabling both regulatory compliance and detailed financial analysis. The dual functionality of iXBRL makes ESEF tagging a powerful tool that enhances transparency and reliability in financial reporting.

ESEF Taxonomy

The ESEF taxonomy is a structured classification system based on the IFRS (International Financial Reporting Standards) taxonomy. It provides a comprehensive set of tags that represent the concepts used in financial reporting. Key aspects of the ESEF taxonomy include:

- Standard Tags: These tags correspond to common financial concepts such as assets, liabilities, equity, revenue, expenses, etc. They ensure consistency in how these concepts are reported across different companies.

- Extension Taxonomies: Companies can create custom tags (extensions) for specific financial concepts unique to their business that are not covered by the standard ESEF taxonomy. However, these extensions must be anchored to the closest standard taxonomy element to maintain comparability.

- Hierarchical Structure: The taxonomy is organized in a hierarchical structure, with elements arranged in a logical order that reflects the relationships between different financial concepts.

- Label Languages: The ESEF taxonomy includes labels in multiple languages, ensuring that the tags can be understood across different linguistic contexts within the EU.

- Namespace and Schema: The taxonomy is defined within an XML namespace, and its structure is described using XML schema definitions (XSD), ensuring that the tags are both machine-readable and standardized.

The ESEF taxonomy is essential for ensuring that financial reports are prepared in a consistent and standardized manner, facilitating better analysis, comparison, and regulatory oversight of financial information across the EU.

Who Needs to Comply with ESEF Reporting?

Types of Companies Affected

The ESEF reporting requirements apply to the following types of companies: EU and EEA Listed Companies: Any company whose securities (such as shares or bonds) are listed on a regulated market within the European Union.

Geographical Scope

The geographical scope of ESEF reporting includes all member states of the European Union, where companies listed on regulated markets must comply with ESEF standards.

It also extends to European Economic Area (EEA) countries, including Iceland, Liechtenstein, and Norway, which adopt ESEF reporting requirements.

Additionally, companies with cross-border listings on both EU/EEA and non-EU/EEA regulated markets must ensure their financial reports meet ESEF standards for their EU/EEA listings.

Compliance Concerns for Newly Listed Companies

Newly listed companies need to consider the following compliance concerns:

- Initial Preparation: Companies planning to go public on an EU-regulated market must ensure that their financial reporting systems and processes are capable of producing ESEF-compliant reports from the outset. This includes adopting iXBRL tagging and preparing reports in XHTML format.

- Training and Resources: Newly listed companies may need to invest in training for their finance and reporting teams to understand and implement ESEF requirements effectively. They may also need to acquire or develop the necessary technical resources and software tools for ESEF compliance.

- Timeline and Deadlines: Companies must be aware of the reporting deadlines and timelines stipulated by their specific EU member state’s regulatory authorities. Timely preparation and submission of ESEF-compliant reports are critical to avoid penalties and ensure regulatory compliance.

- Audit and Assurance: Newly listed companies should engage with their auditors early in the process to ensure that their ESEF reports meet the required standards and that any issues are addressed before the submission deadline. An external assurance on the accuracy of the iXBRL tagging may be required.

- Regulatory Guidance: Newly listed companies need to stay updated with guidance and updates from ESMA and national regulatory authorities. This includes understanding any changes to the ESEF taxonomy, validation rules, and compliance expectations.

By addressing these concerns and ensuring that their financial reporting processes are aligned with ESEF requirements, newly listed companies can achieve compliance and contribute to the overall transparency and comparability of financial information in the EU.

Facilitating and overcoming the challenges

As ESEF continues to shape the future of financial reporting, it’s essential for companies to embrace this standard to enhance transparency, compliance, and efficiency. There are tools in the market designed to facilitate this process, such as our XBRL-certified product, CFOUR Comply. This seamless and user-friendly software simplifies the creation, tagging, and validation of financial reports, ensuring you meet all ESEF requirements with ease.

CFOUR Comply leverages AI to automate tagging, making ESEF reporting easier and more efficient. With our intuitive interface and quick setup, you can generate and submit accurate, compliant reports swiftly.

CFOUR Comply serves as a comprehensive platform, enabling the tagging team, company stakeholders, and auditors to collaborate seamlessly, thereby improving both collaboration and efficiency. Its roll-forward tagging feature ensures accuracy and simplifies future tagging, making compliance a breeze.

The Future of ESEF

Potential Expansions and Changes in ESEF Compliance

As ESEF matures and evolves, several potential expansions and changes could further shape its landscape:

Broader Adoption: While currently mandatory for listed companies within the EU and the EEA, there’s potential for broader adoption in additional countries, enhancing global comparability of financial information.

Expanded Scope: The scope of ESEF could be expanded to include not only annual financial reports but also quarterly or half-yearly reports, providing more timely information to stakeholders.

Enhanced Taxonomy: Continuous updates and enhancements to the ESEF taxonomy will likely occur to keep pace with changes in financial reporting standards and practices, ensuring it remains relevant and useful.

Integration with Other Reporting Standards

Integration with other reporting standards is a critical area of development for ESEF, particularly with initiatives like the Corporate Sustainability Reporting Directive (CSRD).

As the EU pushes forward with its sustainability agenda, integrating ESEF reporting with sustainability reporting under the CSRD could become a requirement. This integration would involve aligning financial reporting with environmental, social, and governance (ESG) disclosures, providing a holistic view of a company’s activities.

Furthermore, there is a growing trend towards the unification of financial and non-financial reporting into a single framework. This could necessitate modifications in the ESEF taxonomy to include non-financial metrics, thereby facilitating integrated reporting.

Nonetheless, integrating ESEF with other reporting frameworks, such as XBRL US GAAP, IFRS, or regional reporting standards, could significantly enhance the interoperability of financial data globally, making it easier to compare across borders.

Future Implications for Financial Professionals

The evolution of ESEF reporting holds several implications for financial professionals. One key area is skill development; professionals will need to continuously update their skills, particularly in data analytics, XBRL tagging, and integrated reporting. Understanding the technological aspects of ESEF reporting, such as software for iXBRL tagging and data validation, will become increasingly important.

The role of financial professionals is likely to evolve beyond traditional reporting, with a greater focus on strategic data interpretation and decision-making support. As reporting becomes more automated, the value added by financial professionals will shift towards analytical and advisory capacities.

Regulatory compliance is another critical area, as staying ahead of regulatory changes will be crucial. Professionals will need to monitor developments in ESEF reporting requirements closely and ensure compliance as the standard evolves and expands.

The integration of financial and non-financial reporting will also require enhanced collaboration between finance, sustainability teams, and IT departments, breaking down silos and fostering a more integrated approach to corporate reporting.

The future of ESEF reporting is poised for significant developments that will expand its scope and impact, necessitating adaptations by companies and professionals alike. This evolving landscape will likely bring about enhanced transparency and efficiency in financial reporting, benefiting companies, investors, and other stakeholders across the financial ecosystem.

For a step-by-step guide on how to get started with ESEF compliance, check out our ESEF in Practice: A Step-by-Step Guide for financial professionals. This resource will provide you with everything you need to know about implementing ESEF smoothly and efficiently.