XBRL (eXtensible Business Reporting Language) is a standard for digital financial reporting. It allows businesses to submit structured, machine-readable financial data that can be processed automatically by regulators, investors, and analysts.

For companies required to file reports under regulations such as ESEF (European Single Electronic Format) and CSRD (Corporate Sustainability Reporting Directive), understanding XBRL is essential. This guide explains what XBRL filing is, how it works, and why it benefits organisations looking to streamline compliance.

What is XBRL Filing?

XBRL filing is the process of submitting financial reports in a structured digital format, making data easier to analyse and compare. Instead of static documents, reports use XBRL tags that label each data point, ensuring accuracy and consistency.

XBRL filing is required under various regulatory frameworks, including:

- ESEF (European Single Electronic Format) – Mandatory for listed companies in the European Economic Area (EEA).

- CSRD (Corporate Sustainability Reporting Directive) – Expands reporting obligations to sustainability data.

Key components of XBRL filing include:

- XBRL taxonomy – Defines standard tags for financial data.

- Tagging financial data – Assigns unique codes to different financial elements.

- Digital reporting format – Converts reports into machine-readable structures.

For businesses preparing for XBRL compliance, selecting the right XBRL software is crucial.

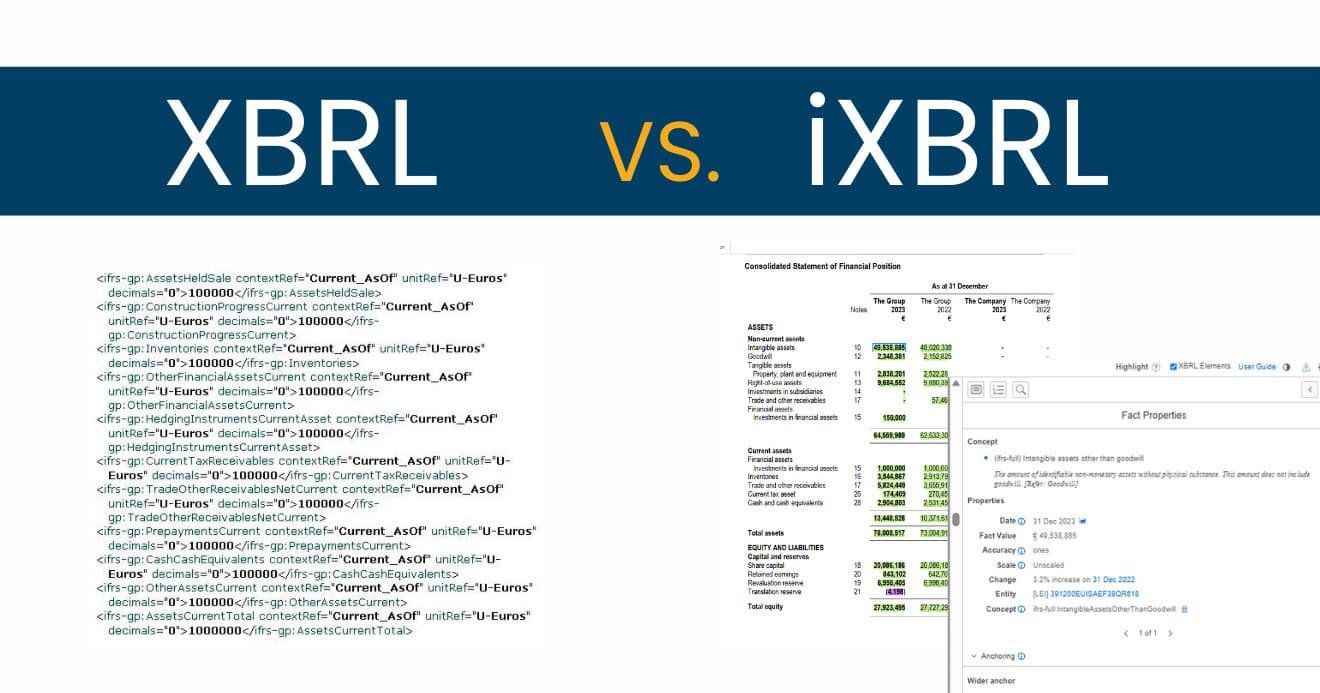

XBRL vs. iXBRL

While XBRL provides a structured data format, iXBRL (Inline XBRL) is now the preferred standard.

- XBRL stores financial data separately from its presentation, making it ideal for automated processing.

- iXBRL integrates XBRL tags directly into an XHTML document, allowing both humans and machines to read the report.

Today, iXBRL is widely used for reporting, and modern xbrl software solutions, such as CFOUR Comply, support the latest format.

.xbri – A New Format Requirement for iXBRL Fillings 2025

In July 2024, ESMA published an update to the ESEF Reporting Manual, which specifies that starting in 2025, reports must be submitted in the .xbri file format. While the reports will still be prepared in iXBRL, the .xbri format is now the required file format for these iXBRL documents, as per the latest regulatory update.

CFOUR Comply generates XBRL in the new .xbri format, ensuring full compliance with the updated regulatory requirements.

The XBRL Benefits

- iXBRL offers several advantages for businesses and regulators.

- Greater accuracy – Reduces human errors in financial reporting.

- Faster processing – Automates data extraction and validation.

- Improved transparency – Provides consistent and comparable reports.

- Regulatory compliance – Meets global financial reporting standards.

- Cost efficiency – Lowers administrative burden over time.

By using XBRL, organisations can enhance financial data integrity and simplify compliance with evolving regulations.

Drawbacks of XBRL Filing

Despite its benefits, XBRL filing presents some challenges.

- Complexity – First-time users may find tagging financial data difficult.

- Initial costs – Investing in XBRL software and training is required.

- Time-consuming – Preparing reports correctly takes effort.

- Regulatory updates – Businesses must stay informed on changing XBRL taxonomy.

These challenges can be managed by choosing user-friendly XBRL solutions, such as CFOUR Comply, which automate tagging and validation.

How to Get Started with XBRL Filing

A structured approach makes XBRL filing easier.

- Understand regulatory requirements – Identify the reporting framework relevant to your business.

- Choose the right XBRL software – Select a solution that automates compliance.

- Tag financial data correctly – Use the XBRL taxonomy to apply the correct labels.

- Validate and submit – Ensure the report meets regulatory standards before submission.

Starting early reduces stress and avoids last-minute errors. Businesses can streamline the process with CFOUR Comply, which simplifies XBRL filing and validation.

Conclusion

XBRL filing is a key requirement for regulatory compliance, offering greater accuracy, efficiency, and transparency in financial reporting. While it presents some challenges, the right tools make compliance manageable.

Simplify your XBRL filing today. Request a demo to see how CFOUR Comply can help.

Frequently Asked Questions (FAQs) about XBRL Filling

- What is XBRL filing?

XBRL filing refers to the process of submitting financial or other business-related data in the XBRL format. It’s a digital filing system where companies tag their financial reports (such as balance sheets, income statements, etc.) with predefined XBRL tags. These tags define the meaning of the data and allow it to be easily processed, analysed, and compared by computers, regulators, and investors.

- What companies need XBRL?

Companies that are publicly listed or subject to regulatory reporting requirements often need to use XBRL for filing their financial reports. In the EU, publicly listed companies are required to file their annual financial reports in iXBRL (an inline version of XBRL) under the ESEF regulation. Large or public companies in also need to report on ESG data in iXBRL as part of the CSRD regulations.

- Who needs XBRL reporting?

Reporting in XBRL is required from companies under ESEF and CSRD regulations. Specifically, publicly listed companies in the EU must submit their annual financial statements in iXBRL format under the ESEF regulation. The CSRD regulation extends this requirement to large companies, mandating the disclosure of ESG data in a structured format, often using XBRL/iXBRL. Both regulations aim to standardise reporting and make financial and non-financial data more accessible and comparable across the EU.

- What do you mean by XBRL reporting?

XBRL reporting involves using the XBRL format to create and submit structured financial reports. These reports are machine-readable, making it easier to automate analysis and ensure consistency across financial data.

- Can you open XBRL with Excel?

Yes, you can open XBRL files with Excel, but it requires an XBRL add-in or specialised software to interpret and display the data in a usable format.