The CSRD timeline is a key focus for companies operating within the European Union. The Corporate Sustainability Reporting Directive (CSRD) introduces phased reporting requirements, expanding the scope of corporate sustainability disclosures.

This article outlines the CSRD timeline, clarifies reporting phases, and explains what steps your organisation can take to prepare. It also provides you with latest updates to the CSRD reporting requirements from EFRAG and European Commission’s Omnibus Proposal, which was published on February 26, 2025 with series of revisions.

Understanding the CSRD Reporting and Its Goals

What Is the CSRD?

The CSRD, enacted by the European Union, was created to improve corporate transparency in sustainability reporting. It builds upon the Non-Financial Reporting Directive (NFRD), expanding the scope to cover more companies and introducing standardised reporting requirements.

Detailed Reporting

The CSRD requires detailed disclosures of sustainability-related information in the organisation’s management report.

Mandatory Assurance

Mandatory third-party assurance is required with the same level of scrutiny as financial data.

Digital Tagging

Sustainability information needs to be tagged in the management report and submitted using the XBRL format.

CSRD Goals

Regulatory Compliance and Penalties

Failure to comply with CSRD reporting can lead to penalties, reputational damage, and potential loss of investment opportunities. Early preparation helps mitigate these risks.

Stakeholder and Investor Expectations

Today’s investors place great emphasis on sustainable and responsible business practices. Transparent ESG reporting can improve stakeholder trust and attract investment.

Alignment with EU Sustainability Goals

By complying with the CSRD, businesses contribute to broader climate and social objectives, aligning with the EU’s long-term policy changes.

The Corporate Sustainability Reporting Directive (CSRD) Timeline: Who and when?

The CSRD requires extensive sustainability reporting from a wide array of entities, both within and outside the EU. Originally, it was estimated that 50,000 companies would need to comply, but this number is now significantly reduced, particularly due to the exclusion of SMEs and certain smaller enterprises. Here’s an updated look at the timeline for different company groups:

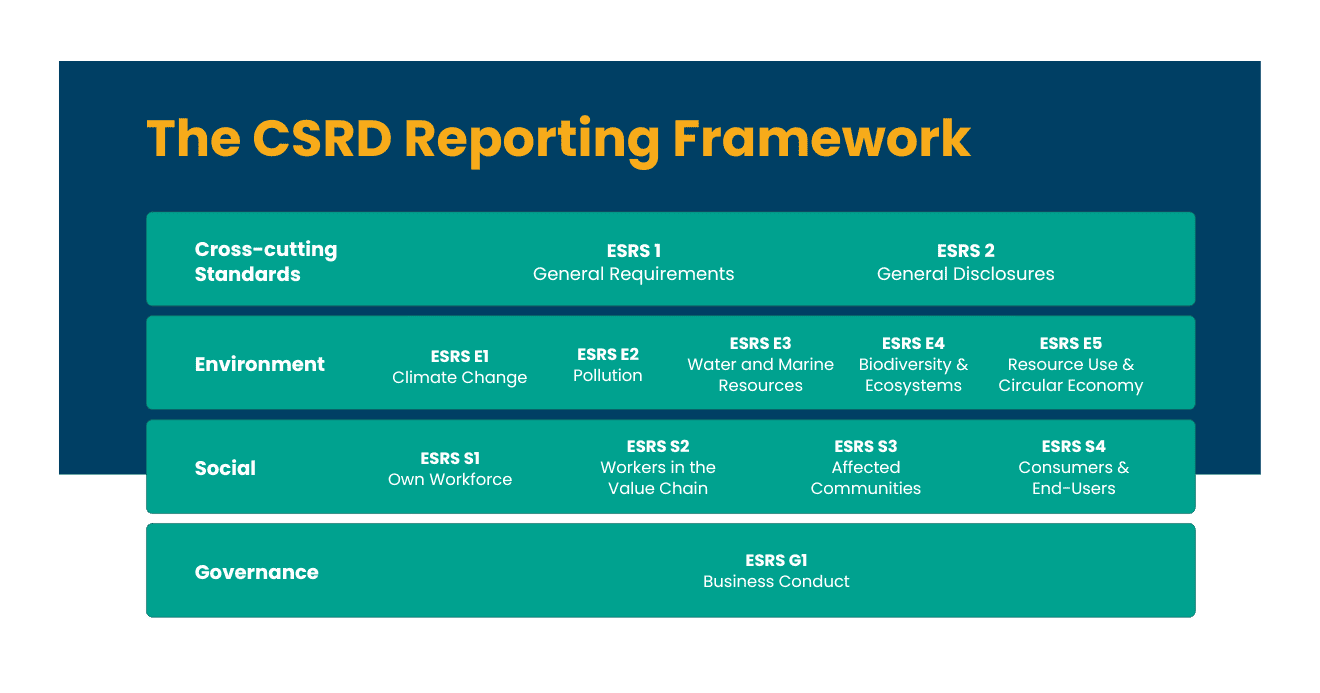

The CSRD reporting framework

The CSRD mandates reporting on Environmental, Social, and Governance (ESG) factors. Companies must adhere to the European Sustainability Reporting Standards (ESRS), which provide detailed frameworks for disclosure.

Reduction of Sector-Specific Data

This change refers to a simplification of the specific ESG data that companies were previously required to collect based on their industry. Different sectors (e.g., energy, manufacturing, agriculture) had different reporting requirements due to their unique environmental and social impacts. The Omnibus proposal reduces or removes some of these specific requirements, aiming to make the reporting framework less complex and more streamlined.

For example, sectors like agriculture and energy, which had complex, detailed reporting needs around emissions, resource use, and waste, may now have less stringent requirements or more generalised criteria for reporting.

Narrowing the Supply Chain Data

This change specifically focuses on the scope of data companies need to collect from their supply chains. Before the Omnibus proposal, companies were required to gather ESG data from their entire supply chain, often extending well beyond direct suppliers. The new regulation narrows this requirement by focusing only on direct partners, unless significant risks are identified further down the supply chain.

Key Revisions of CSRD Under the Omnibus Proposal

The European Commission’s Omnibus Proposal introduced several updates that affect the CSRD requirements:

-

Fewer Companies Affected: The CSRD’s scope has been reduced. The new proposal removes listed SMEs and large companies with fewer than 1,000 employees from the reporting obligations. This reduces the number of companies affected by the CSRD by 80%.

-

Extended Reporting Deadlines: The deadline for large companies to comply with the CSRD has been postponed from 2026 to 2028, with reporting based on data from the 2027 fiscal year. Similarly, listed SMEs that were supposed to comply in 2027 will no longer be required to do so. For Non-EU companies, the deadline remains unchanged at 2029 for data from the 2028 fiscal year.

-

Simplified Reporting Framework: The sector-specific ESG standards have been removed, simplifying the reporting framework and reducing the amount of data to be disclosed.

-

Narrower Supply Chain Reporting: Companies will now only need to collect sustainability data from direct partners, unless significant risks exist further in the supply chain.

-

Eased Assurance Rules: The previous requirement for reasonable assurance has been scrapped, and companies will now only need limited assurance for sustainability disclosures.

Preparing for the CSRD Compliance

The scope and detail of CSRD reporting require careful preparation. Companies should consider the following steps:

- Understand the submission period for your report.

2. Conduct a double materiality assessment.

This assessment involves evaluating both the impact of the company’s operations on the environment and society, as well as how sustainability factors affect the company’s financial performance. For more detailed guidance, refer to EFRAG IG 1: Materiality Assessment and EFRAG IG 2: Value Chain. However, these guides will be adjusted following the Omnibus proposal. The revised framework will focus reporting on the value chain only for direct partners and reduce the amount of sector-specific data. This simplifies the assessment process by narrowing the scope of reporting.

3. Prepare a data gap analysis.

Once you have identified which topics are material to your company, perform a data gap analysis to understand whether the company is collecting the necessary data according to the indicators defined in the ESRS. Detailed datapoints can be found in EFRAG IG 3: Detailed ESRS Datapoints, which is followed by Explanatory Note. However, with the changes proposed, sector-specific data requirements will be reduced, simplifying the data collection process for companies, particularly in industries where detailed sectoral metrics were previously required.

4. Collect required data on material topics.

After the data gap analysis, you can begin the data collection. Processes should be established to enable effective data collection on all required indicators.

5. Structure your report according to the ESRS requirements.

The ESRS 1 provides an example structure of how the sustainability information should be presented in the report, and it should include four sections including: General Information, Environmental Information, Social Information, and Governance Information.

6. Find the appropriate tool for digital tagging of sustainability information.

Modern reporting platforms, such as CFOUR Comply, can simplify electronic reporting through automated tagging.

The Importance of Timely Action

For leaders, the implications of CSRD compliance extend beyond regulatory adherence. Transparent ESG reporting aligns with investor expectations, strengthens stakeholder trust, and solidifies your organisation’s strategic positioning in a sustainability-driven economy.

Conversely, delaying preparation exposes your business to unnecessary risks, including fines, reputational harm, and missed opportunities for leadership in ESG initiatives.

Start preparation early. Equip your team with automated tagging software while conducting the necessary assessments. This allows ample time for your team to familiarise themselves with the system, so once the assessments are completed and data is collected and structured, they will be ready to use it.

Ensure a smooth preparation for CSRD – Request a demo of CFOUR Comply.

The CSRD Timeline and Reporting - Frequently Asked Questions

- What is the timeline for CSRD?

The CSRD timeline details the gradual implementation of the Corporate Sustainability Reporting Directive, starting in 2024. Organisations in the first phase are required to report in 2025, covering the financial year ending in 2024. The implementation timeline extends until 2029.

- When did the CSRD reporting start?

The Corporate Sustainability Reporting Directive (CSRD) came into force on 5 January 2023. The first wave of reporting launched in 2025, and the next one is scheduled for 2028.

- Who is required to report in 2025?

In 2025, the CSRD will apply to companies previously reporting under the NFRD. These include companies with over 500 employees, a net turnover exceeding €50 million, and assets above €25 million.

- What happens if you miss the CSRD deadlines?

Failure to comply can lead to financial penalties and harm a company’s reputation, as customers, investors, and other stakeholders may lose trust in the company.

- Are SMEs allowed to delay reporting?

The Omnibus proposal suggested a few revisions, one of them is to exclude listed SMEs from scope of CSRD. However, they might need to report in the future.

- What is the difference between CSRD and SFDR?

The CSRD (Corporate Sustainability Reporting Directive) requires large companies and listed SMEs to disclose detailed sustainability information, covering environmental, social, and governance (ESG) aspects. The SFDR (Sustainable Finance Disclosure Regulation) mandates financial market participants to disclose how they integrate sustainability risks into their investment processes and products. Both regulations are part of the EU’s broader Sustainable Finance Framework.

- How many companies fall under CSRD?

According to the original content of CSRD, 50,000 companies had to comply, including approximately 40,000 based in the EU and 10,000 outside of it. With the latest revisions, proposed in Omnibus proposal by European Commission, approximately 6,000 companies will be affected.

- Who will be required to report under the CSRD in 2026?

According to the proposed revisions in the Omnibus proposal, no companies will be required to report in 2026 for the fiscal year 2025. The next wave of reporting will occur in 2028, for the 2027 data. This wave affects large entities that meet certain criteria. Discover more by reading the full article.

- Who will need to report under the CSRD in 2027?

The proposed revisions in the Omnibus proposal indicate that no companies will need to report in 2027 for the 2026 fiscal year. The next reporting wave will take place in 2028, covering 2027 data. This wave targets large entities that meet specific criteria. Learn more by reading the full article.

- Which companies will need to report under the CSRD in 2028?

In 2028, large companies that meet certain criteria will be required to report under the CSRD for the 2027 fiscal year. These criteria are having over 1000 employees, €50 million in net turnover, or €25 million in assets. Companies that meet at least two of these criteria will have to provide reports by 2028.