The European Single Electronic Format (ESEF) is a reporting standard introduced by the European Securities and Markets Authority (ESMA). It ensures that publicly listed companies in the European Economic Area (EEA) submit their annual financial reports in a machine-readable format.

The primary goal of ESEF is to make financial reports more accessible, structured, and transparent for investors, regulators, and analysts. By enforcing a uniform digital format, ESEF simplifies the process of analysing financial data and comparing reports across different companies and industries.

This guide explains what ESEF is, why it matters, and how businesses can meet compliance requirements efficiently.

Understanding ESEF Compliance

ESEF standardises financial reporting across Europe, making it easier for investors and regulators to compare financial statements.

Key points:

- Publicly listed companies must submit financial reports in XHTML format.

- Consolidated financial statements must be tagged using iXBRL (Inline XBRL).

- Financial data becomes more accessible for automated analysis.

Who Must Comply with ESEF?

ESEF applies to:

- Companies listed on regulated markets in the European Economic Area.

- Publicly traded companies must prepare annual financial reports using the ESEF format to comply with EU transparency regulations.

- Organisations producing consolidated financial statements under IFRS.

- Companies that report under International Financial Reporting Standards (IFRS) must tag their consolidated financial statements in iXBRL, ensuring data consistency and accuracy.

- Firms overseen by ESMA and national regulators.

- National regulators across Europe monitor ESEF compliance. Companies that fail to follow ESEF reporting guidelines may face penalties, increased scrutiny, or regulatory intervention.

- Non-compliance can lead to penalties, such as fines, legal actions, operational restrictions and, eventually, loss of trust from investors and stakeholders.

What Happens if a Company Does Not Comply?

Failure to comply with ESEF reporting standards can lead to serious consequences, including:

- Financial penalties – Companies may face fines imposed by national regulators.

- Legal risks – Non-compliance could lead to regulatory investigations or legal disputes.

- Operational restrictions – Some firms may face reporting delays or suspensions from financial authorities.

- Loss of investor confidence – Investors rely on accurate financial reports to make decisions. Non-compliance can damage a company’s reputation.

Why Was ESEF Introduced?

Before ESEF, financial reports were submitted in various non-standardised formats, making it difficult to compare data between companies.

With ESEF, all reports follow a digital, structured format, ensuring that financial statements:

- Are easy to access, analyse, and compare using modern financial tools.

- Reduce errors and inconsistencies through automated data tagging.

- Improve market transparency by allowing investors to review clear, standardised reports.

ESEF enhances financial accuracy, accessibility, and regulatory oversight, making reporting more efficient and reliable.

Key Benefits of ESEF

- Consistent reporting: Companies follow a uniform reporting format.

- Greater transparency: Investors can easily compare financial data.

- Fewer errors: Automated tagging reduces mistakes.

- Better regulatory oversight: Authorities can quickly identify discrepancies.

If you want to understand the regulatory background of the ESEF, ESMA’s role in the directive development and implementation timeline, ESEF Reporting Explained offer a comprehensive overview of these.

ESEF Reporting Requirements

-

XHTML Format

Annual financial reports must be submitted in XHTML format. This ensures compatibility with web browsers and financial data analysis tools.

-

iXBRL Tagging

- iXBRL (Inline XBRL) integrates financial data directly into an XHTML document.

- IFRS taxonomy must be used to tag financial statements.

- From 2022 onwards, narrative disclosures also require block tagging.

-

Validation & Filing

- Companies must validate iXBRL files to ensure accuracy.

- Reports must comply with ESMA regulations.

- Submission is required via National Competent Authorities (NCAs).

What does this mean for companies?

- Businesses must use XBRL-compliant software to create reports.

- Financial teams need to understand iXBRL tagging to ensure accurate reporting.

- Reports must be validated before submission to avoid compliance issues.

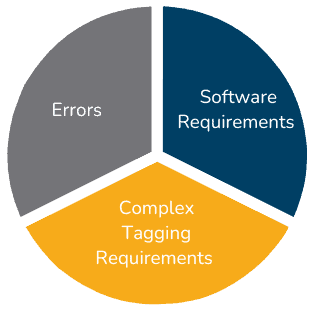

ESEF Compliance: Key Challenges

-

Complex Tagging Requirements

Applying correct XBRL tags requires expertise in IFRS taxonomy and financial reporting.

-

Software Requirements

Businesses must consider:

- Software investments for ESEF reporting.

- Training finance teams or hiring experts.

- Ensuring compliance while maintaining efficiency.

-

Errors

- Incorrect tagging – Use software with automated validation, such as CFOUR Comply.

- Manual errors – Follow a structured ESEF workflow.

- Delays in adoption – Start preparations early to avoid last-minute issues.

New ESEF Updates and Future Developments

ESEF continues to evolve. Key updates include:

- More narrative disclosures require block tagging – Improving transparency in financial reports.

- Sustainability Reporting Integration – CSRD (Corporate Sustainability Reporting Directive) will impact future reporting obligations.

- Advancements in AI-powered XBRL tagging – Automated tools like CFOUR Comply help businesses tag financial data faster and more accurately.

How to Comply with ESEF Easily

The best is to start preparing early. If you’re new to the regulation, read ESEF compliance in practice.

Best Software Solutions for ESEF Compliance

Companies can simplify compliance using ESEF reporting software.

Key features to look for:

- XBRL certified solutions – this ensures that the reports will be accepted by the authorities.

- Automated iXBRL tagging – saves time on manual, repetitive tasks.

- Built-in validation checks – your reports will be accurate and consistent.

- Easy-to-use interface – less training will be required.

Read the comparison of the best xbrl software solutions for ESEF compliance to choose one for your team.

CFOUR Comply is a tool developed to simplify the ESEF compliance. It holds a certification from XBRL, and offers robust features, that go beyond simple tagging.

- By leveraging AI, CFOUR Comply learns from your reports and suggests tags based on the previous financial data.

- With FUJITSU Interstage XWand Runtime Processor, which provides a market leading XBRL validation engine, it ensures that the XBRL generated is compliant with all the latest requirements.

- Collaboration features allow to work on report with a team, giving each member appropriate level of access.

Need an easy way to comply with ESEF?

Book a demo of CFOUR Comply

FAQ - What is ESEF? (European Single Electronic Format Explained)

- Is ESEF mandatory?

Yes, all publicly listed companies in the European Economic Area (EEA) must comply with ESEF regulations when submitting their annual financial reports.

- What is the meaning of XBRL?

XBRL (eXtensible Business Reporting Language) is a digital format used to structure financial data, making it easier for regulators, investors, and analysts to process and compare reports.

- What is ESEF?

ESEF (European Single Electronic Format) is a reporting standard introduced by ESMA that requires listed companies to submit their financial statements in a machine-readable format, ensuring accuracy and transparency.

- What are the non-financial disclosure requirements?

ESEF primarily applies to financial statements, but some companies must also report on sustainability metrics and other non-financial data under the Corporate Sustainability Reporting Directive (CSRD).

- What is the purpose of ESEF?

ESEF improves transparency, ensures financial data is easily accessible, and helps investors compare company reports across different markets.